5th July 2019

Niranjan presented at the Australian British Financial Services Catalyst on the 2nd July 2019. The catalyst examined the challenges facing financial institutions with the rapid change of technology and customer expectations. Challenges included new regulations, data security and building the platforms for future banking while ensuring the wealth of data from legacy systems is maintained.

Speaking on the topic of: Digital Transformation in Financial Services Niranjan detailed how Open Orbit or “software that mimics a consultant” has helped large financial organisation rapidly speed up the pace of transformation within their organisation.

Describing the impact of Open Orbit’s expertise automation software in lifting the velocity of change in incumbent businesses, he summarised:

Our technology enables users to solve problems better and faster. Too often in large organisations we see people categorised as those running the ship or those driving change. We want to remove that distinction. We enable business users to self-serve their way to better business using algorithmic guidance to solve the issues with how work is done today.

In his presentation, Niranjan outlined three companies/departments that utilised Open Orbit’s technology, including: Improving capacity in the mortgage division of a bank, cost reductions across investment reconciliations of a major US bank and increase revenue across policy reinstatement for one of the top five life insurers in Australia.

More information on these case studies has been provided below:

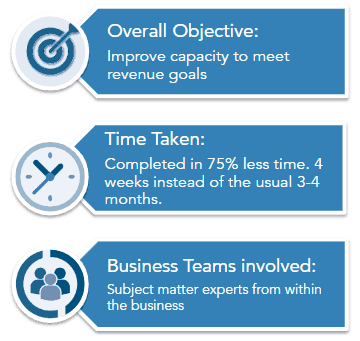

HSBC Australia (Mortgages):

A new market campaign was about to double volume of applications into the mortgage department but capacity constraints were already preventing timely provision of letter of offer.

Findings and conclusions:

Utilising the Open Orbit platform helped HSBC avoid costly digression into fixing things that wouldn’t have helped – for example, a large number of customer communication templates.

Open Orbit guided users to double capacity by focusing on a few IT fixes to the originations platform and some re-training of front-line staff.

Large American Bank (Investment Account Reconciliations)

Identifying over-capacity to enable the business to release, restack or reload in line with cost targets.

Findings and conclusions:

It was important that diagnostics of the process was fast, scalable with minimal impact on business operations.

A ‘happy path’ model using expertise automation meant subject matter experts could relate to their process and extract more insight out of the limited data available with 20% over-capacity was identified within a week

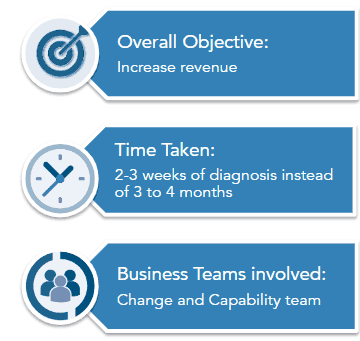

Australian Life Insurer – Ranked in top 5 insurers in Australia by revenue (Policy Reinstatement)

The insurer recognises the importance of timely reinstatement of insurance for existing customers who had allowed the policy to lapse.

Findings and conclusions:

- End to end cycle time was brought back into focus, replacing interim and internal service levels

- The team did away with the legacy of onerous data requirements and approvals

Open Orbit is ‘software that mimics a consultant’ continues to empower Operations teams to think like improvement practitioners and drive better business. Helping business users to become part of the solution to the efficiency challenge, rather than just suffer the problems of bad processes.

If you would like to know more about Open Orbit’s software and how it can help drive your business users to better, cheaper and more efficient processes please feel free to contact the Open Orbit leadership team below:

Niranjan Deodhar

Founder, Open Orbit

niranjan.deodhar@openorbit.net

Mobile: + 61 404 012 676

Julian Humphreys

Chief Marketing Officer

julian.humphreys@openorbit.net

Mobile: + 61 423 799 233

Pooja Majmudar

Head of Customer Success

pooja.majmudar@openorbit.net

Mobile: + 91 97694 90051